Buy properties in Dubai. Best real estate investment tips.

Dubai has developed radically over the past few decades from a small trading port to a major global economic hub partly due to prudent investments and policies related to real estate. The emirate’s real estate sector has evolved dramatically since the early 1990s when construction activity gradually increased.

Since the mid-2000s, Dubai went through an unprecedented property boom driven by large infrastructural developments and global investor interest. Mega projects ranging from iconic buildings and luxury resorts to new cities transformed Dubai’s skyline and landscape. However, the financial crisis halted much of the growth temporarily during 2008-2010.

Nevertheless, the market recovered strongly, supported by the government’s real estate stimulus initiatives and vision for 2021. Today, Dubai ranks high on the global property investment index due to its tax-free environment, robust property laws and stable economic growth.

The real estate demand is driven by factors such as business hub status, world-class infrastructure and amenities, a multicultural population, and high rental yields for investors. While the off-plan sales and overall supply have reduced compared to the pre-crisis scale, the current trends point towards a gradual and sustained recovery.

The upcoming World Expo 2020 is anticipated to offer new investment opportunities.

Choosing a suitable area is one of the critical decisions when investing in Dubai’s real estate market. Some of the most popular and established locations include Downtown Dubai, Dubai International Financial Centre, Business Bay, Jumeirah Lakes Towers and Emirates Hills.

It is prudent to research various localities, focusing on their infrastructure quality, amenities and connectivity options. For example, Downtown Dubai offers retail therapy and access to Dubai Metro and Sheikh Zayed Road. Similarly, the business hub Jumeirah Lakes Towers (JLT) hosts many corporate offices and is in a prime location close to the airport.

Moreover, one must check for plans of upcoming infrastructure projects while shortlisting an area. For instance, the Expo 2020 site and surrounding districts are set for major developments, likely augmenting property values. Likewise, the extension of Dubai Metro’s Green and Purple lines will increase the accessibility of previously less connected areas like Dubai Healthcare City.

Furthermore, considering factors like proximity to metro stations and major roads is advisable to ensure a hassle-free commute. Living close to stations allows hassle-free mobility within the vast city. Similarly, direct access to the Sheikh Zayed Road or Sheikh Mohammed Bin Zayed Road enables transportation and connectivity to other emirates.

Thoroughly evaluating these location attributes assists investors in selecting areas with longevity and good appreciation prospects.

The right choice of locality goes a long way in achieving higher rental yields and capital gains over the long term.

Gauging prevailing buying prices and prevailing rental rates and inspecting historical price and yield trends in shortlisted areas are important for investment assessment. Property prices vary significantly across localities in Dubai; for instance, units in Downtown Dubai and Palm Jumeirah command higher rates than other locations.

It is insightful to examine how property values and rents have evolved over the past few years in different sub-markets. Locations offering strong capital appreciation alongside decent rental returns should be prioritized. The track record provides an idea about the area’s demand-supply dynamics and future potential.

One should also identify relatively affordable areas that still hold promising prospects. For example, Dubai Investments Park offers inexpensive plots and villas while well[1]connected via Al Khail Road. Upcoming neighbourhoods on the outskirts, like Dubai South and Dubai Land, are expanding rapidly with improving infrastructure, which makes them attractive options for long-term gains.

Comparing quantitative data from real estate portals and consulting qualified brokers assists in comprehending the supply-demand scenarios. A balanced study of pricing metrics, historical market movements, and the area’s growth drivers enables shortlisting investments that combine affordability with quality-appreciating assets. This results in maximizing rental yields and capital appreciation over the ownership years.

The selection of a property type relies on intended use and investment objectives.

Residential properties like villas and apartments are common investment options in Dubai’s real estate.

Villas with private gardens and swimming pools provide luxurious living but require higher budgets. However, they witness robust rental demand, especially from large expatriate families. Apartments offer lower entry prices and higher liquidity while similarly enjoying strong yields. Gated community apartments near amenities are a practical investment choice.

In terms of attributes, villas yield higher returns despite higher maintenance costs. Yet, apartments entail lower management efforts with guaranteed rent from state title ownership. Both accommodation types observe an optimistic rental outlook due to Dubai’s growing migrant population.

On the commercial front, office spaces at the burgeoning business hubs such as DIFC, Business Bay and JLT emerge as a steady investment asset class. Retail properties in vibrant communities also observe consistent occupancy rates. However, their success relies on securing reputed tenants under long-term contracts.

A thorough assessment of these property kinds assists in matching investment profiles to suitable options with factors like income generation and capital appreciation potentials.

Financing a real estate investment is an important consideration. Local banks offer competitive housing loans to eligible customers, including Expats. However, one must understand the paperwork and approval criteria, which typically involve a thorough assessment of income stability, collateral and credit history.

Alternatively, new avenues like peer-to-peer lending platforms are emerging, providing cross-border investors access to lower financing rates without strict eligibility norms. These avenues aid financing for property investments.

Legal compliance and documentation form another significant aspect.

As per the latest realty laws, it is prudent to seek advice from expert lawyers to guide through processes like sale purchase agreements, mortgage contracts, title transfers, etc.

Additionally, comprehending the property ownership structures – whether freehold, leasehold or strata – and conforming to the associated terms is important. For instance, strata title properties require complying with the community rules for maintenance works.

Moreover, updating the tax regulations is essential depending on the investor’s residential status. Local investors comply with municipality taxes while NRIs may require reviewing tax treaty benefits.

Adhering to the legal and regulatory framework is key in safeguarding investments. Engaging professionals provides peace of mind for real estate transactions in Dubai.

Proactive maintenance shields properties from damage and depreciation, maximizing rents and resale value. Devising an inspection checklist and timely repairing issues under the guidance of experienced professionals are valuable.

Outsourcing property management to reputed local agencies helps overseas investors. Checking past client testimonials and services offered assists in selecting a reliable partner.

Regular maintenance by experts preserves assets and facilitates hassle-free passive ownership.

Earning optimal rental returns also requires focus. Tapping into tenants is feasible through brokers’ databases, real estate portals and social media advertisements. Competitive pricing coupled with modern amenities attract quality takers.

Drawing rental contracts adhering to standard terms and timelines of the Dubai Land Department safeguards the rights of landlords and tenants. Appointing arbitrators aids in quick dispute resolution through established channels like RERA. This ensures long occupancy, on-time payments and peaceful possessions.

While buy-and-hold remains a profitable long-term strategy, investors may occasionally require asset cashing.

The illiquid nature of physical property calls for careful planning of exit routes.

Selling through experienced real estate agents opens access to Dubai’s vibrant resale market. Agents’ database of buyers and advertising resources helps achieve optimal prices.

Another avenue is refinancing the property later to unlock invested capital without a full sale. Several banks provide competitive refinance packages, making this a practical strategy for experienced owners.

Dubai’s realty has consistently displayed strong capital appreciation over 15-20-year horizons. Neighbourhoods developing infrastructure witness sharp value increases with time.

Gradually rising rents and prices imply holding properties for 5-7 years, then selling during upswings ensures healthy returns exceeding 12-15% on total outlay.

A systematic investment approach and exit planning are thus essential.

This article outlined several useful strategies for investors looking to enter Dubai’s thriving property market. Key aspects discussed included thorough location research, property types and prices analysis, understanding of legal and financing rules, and tips for effective long-term management and exits. Real estate provides a robust avenue to diversify portfolios and gain capital appreciation and stable rental earnings. With its pro[1]business stance and ongoinginfrastructure growth, Dubai’s realty is well-positioned to deliver rewarding returns for patient investors in the coming years

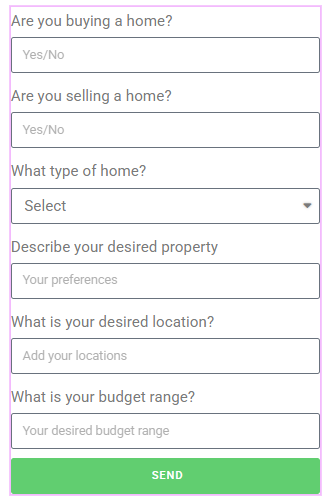

To find a property in Dubai, fill out the form below:

Your article helped me a lot, is there any more related content? Thanks!

Thanks.